How to set up a virtual portfolio

Virtual portfolios let you see how combinations of investments would’ve performed from a date in the past until today.

May 13, 2024

Are you looking to boost your confidence and explore investing ideas risk-free? Virtual portfolios are a simple way to try them out, gain experience, and develop your skills at no cost.

What is a virtual portfolio?

A virtual portfolio lets you “invest” virtual money in a simulated portfolio to see the performance of stocks and ETFs over time. They are easy to create and completely free!

For example, if you’d invested $50 each in stocks X, Y, and Z in 2014, what would that portfolio look like today? Or if you put $100 into 2 different ETFs 6 months ago, how much would they be worth now?

Why use virtual portfolios?

Virtual portfolios let you test and monitor the performance of investment ideas without any risk of losing real money. If you're just getting started, virtual portfolios are a great way to “practice” investing and build your confidence towards doing it for real. They also help demonstrate the potential benefits of diversification.

If you're a more advanced investor virtual portfolios can be a sandbox to play in and experiment with different strategies. You can build a variety of virtual portfolios to track different things--maybe see how securities in certain sectors have fared through changing market conditions.

How to set up a virtual portfolio in the Plynk app

You can create virtual portfolios in just 4 quick steps:

- Think of a name for the virtual portfolio

- Enter a virtual dollar amount to “invest,” which will be spread equally across each stock or ETF

- Choose a date in the past when you’d like the virtual portfolio to start

- Select the securities you want to include (up to 25 stocks and ETFs)

The Plynk app lets you have as many as 10 different virtual portfolios at a time and each one can go back as far as 15 years (spanning your chosen start date up until the previous business day’s market close).

It’s also easy to adjust virtual portfolios however you like. You can change the name, amount, start date, or securities just by clicking on the edit icon in the top right corner of the screen.

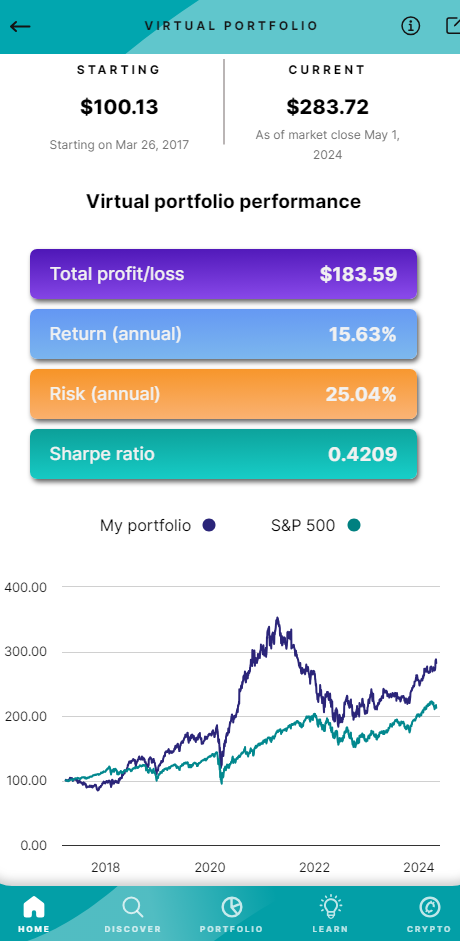

This example is shown for illustrative purposes only.

Virtual portfolio data and insights

When you view a virtual portfolio you’re provided with several metrics to help you further understand it:

- Starting dollar value on the date you selected, as well as the value today

- Graph showing the change in value over time vs the S&P 500

- Total profit or loss as of today

- Annual return: Average percent increase or decrease in price per year

- Annual risk: Measure of the portfolio’s volatility (the higher the percentage the more price fluctuation it averaged per year)

- Sharpe ratio: Comparison of return vs risk (the higher the ratio the better)

You’ll also see the list of securities that are in your virtual portfolio. You can click on any of them to view performance data for each, including:

- Latest price per share

- Graph showing the change in share price over time

- Current value the stock or ETF holds in your virtual portfolio

- Profit or loss in dollar amount, and as a percentage

- Allocation percentage of this security in the total value of your virtual portfolio, both at the start date and as of today (example: If there are 5 securities in your virtual portfolio they all begin as 20% of its value, but this changes over time as the prices of each increase or decrease)

These insights can help you get a better sense of how your virtual portfolio (and the individual securities in it) performed over time. They may be useful when making real investment choices based on your risk tolerance and time horizon. Remember, past performance is no guarantee of future results.

Next steps to consider

Open the Plynk app and start building a virtual portfolio now!

Ready to invest real money? Make a deposit or set up recurring deposits to your brokerage account.